Charitable Gift Annuity

With a charitable gift annuity, you can make a gift and receive fixed payments for life.

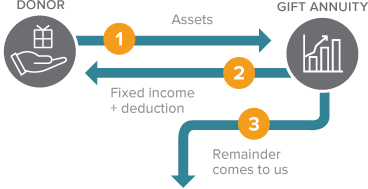

How It Works

- You transfer cash or securities. If you are 70 ½ or older, you can make a one-time, tax-free qualified charitable distribution of up to $54,000 from your IRA to fund a CGA.

- Our minimum gift requirement is $10,000.

- You, yourself and a spouse, or any two beneficiaries you name, will receive fixed payments for life.

- Beneficiaries must be at least 65 years of age at the time of the gift.

- The remaining balance passes to Main Line Health when the contract ends.

- You can also create a life income gift through your IRA. Discover more here.

Benefits

- Receive dependable payments for yourself or loved ones - see today’s rates.

- Payments never change.

- A portion of your gift is tax-deductible, if you itemize.

- If you create a gift annuity using appreciated stock or mutual fund shares you may also save on capital gains taxes.

- A portion of your annuity payment will be tax-free for a number of years.

- Are you a younger donor? Consider a deferred gift annuity.

Next

- More detail on Gift Annuities.

- Frequently asked questions on Gift Annuities.

- Contact us so we can assist you through every step.